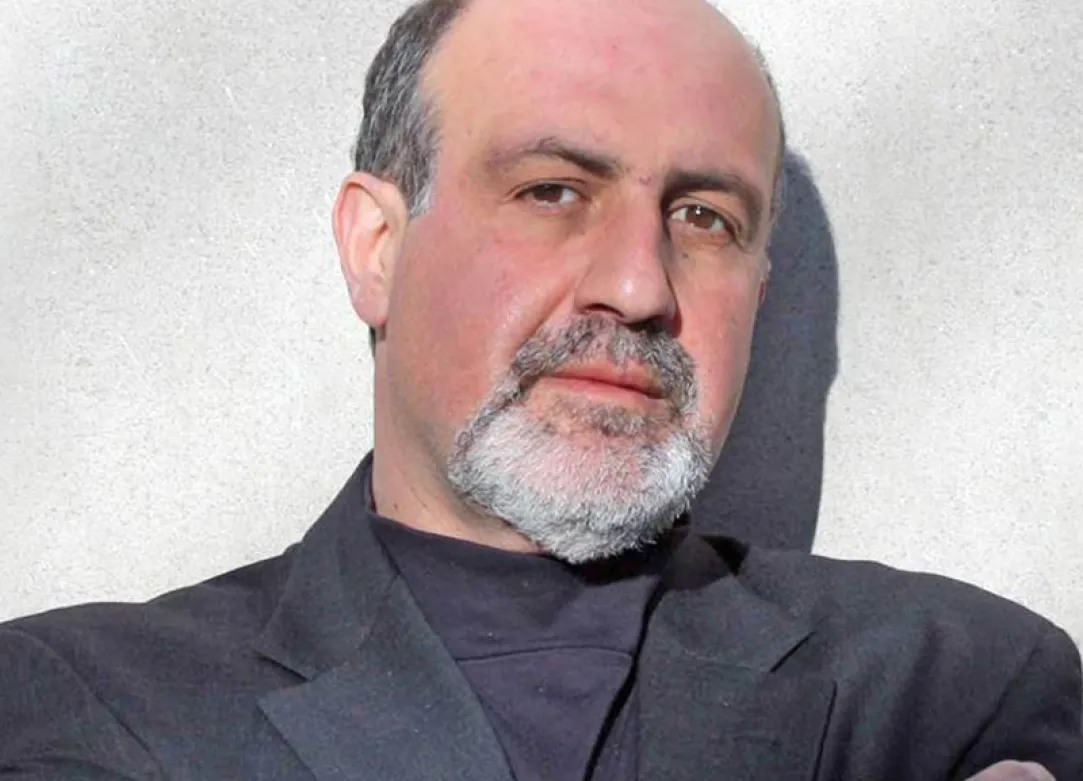

One of the most respected and influential economists in the world, Nouriel Roubini provides an insightful look at what is ahead for the US and global economy.

Nouriel Roubini is the Chairman and CEO of Roubini Macro Associates, LLC, his own global macroeconomic and strategy consultancy firm. He is also a professor of economics at New York University’s Stern School of Business. Dr. Roubini has extensive policy experience as well as broad academic credentials. From 1998 to 2000, he served as the senior economist for international affairs on the White House Council of Economic Advisors and then the senior advisor to the undersecretary for international affairs at the U.S. Treasury Department, helping to resolve the Asian and global financial crises, among other issues. The International Monetary Fund, the World Bank and numerous other prominent public and private institutions have drawn upon his consulting expertise.

He has published numerous theoretical, empirical and policy papers on international macroeconomic issues and coauthored the books “Political Cycles: Theory and Evidence” (MIT Press, 1997) and “Bailouts or Bail-ins? Responding to Financial Crises in Emerging Markets” (Institute for International Economics, 2004) and “Crisis Economics: A Crash Course in the Future of Finance” (Penguin Press, 2010). Dr. Roubini’s views on global economic issues are widely cited by the media, and he is a frequent commentator on various business news programs. He has been the subject of extended profiles in the New York Times Magazine and other leading current affairs publications. The Financial Times has also provided extensive coverage of Dr. Roubini’s perspectives.

Dr. Roubini received an undergraduate degree at Bocconi University in Milan, Italy, and a doctorate in economics at Harvard University. Prior to joining Stern, he was on the faculty of Yale University’s department of economics.